STILL HAVE QUESTIONS?

GIVE US CALL , TEXT OR MESSAGE

THE BEST AMERICAN HEALTHCARE

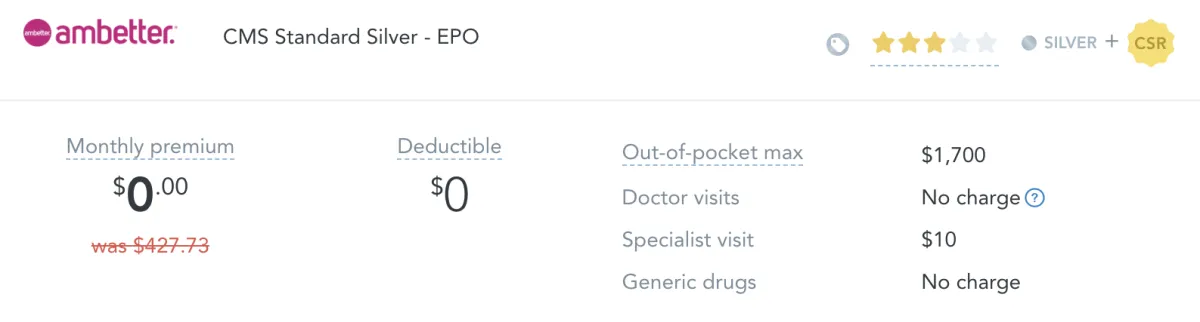

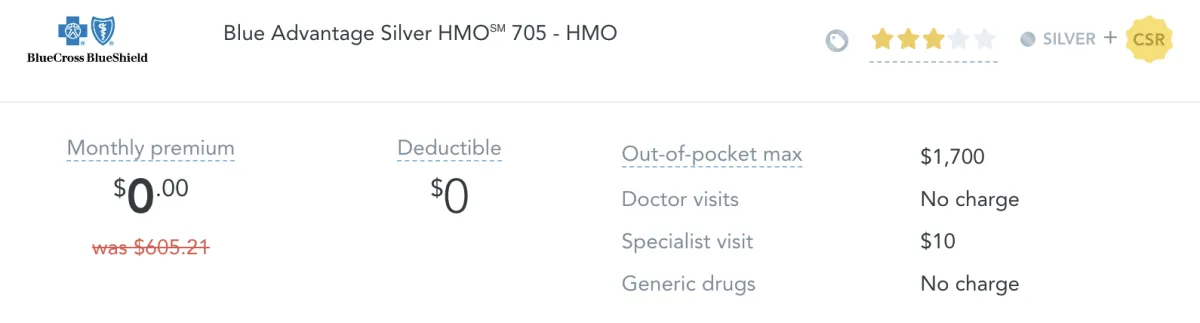

All pre existing Conditions acceptedCan not have medicaid or medicare The Marketplace / Obamacare

LOW INCOME = FREE PLAN

$0 Copays on Drugs & Doctor visits$0 Monthly Premiums$0 Deductibles

GET PAID FOR SHARING

Earn $10 for each person you referUnlimited earning potentialMake money while helping others

DEDICATED CUSTOMER CARE

Find the best plan for your needs24/7 Customer ServiceDoctor & medication Look up

FREQUENTLY ASKED QUESTIONS

WHAT IS A DEDUCTIBLE?

A deductible is the amount of money you have to pay out of your own pocket for your medical expenses before your health insurance begins to pay for the rest of your medical bills.For example, let's say your health insurance policy has a $1,000 deductible. If you have a medical expense that costs $1,500, you will need to pay the first $1,000 of that expense, and then your health insurance will pay for the remaining $500.Deductibles are usually set at the beginning of each policy year and can vary depending on the plan. They can range from a few hundred dollars to several thousand dollars. So, in summary, a deductible is a cost-sharing arrangement between you and your health insurance company. It's the amount you have to pay for your medical expenses before your insurance coverage kicks in.

WHAT IS A COPAY?

A copay is a small amount of money you have to pay when you go to the doctor or get medicine. Think of it like a small fee you pay to get the care you need, and your health insurance pays for the rest of the cost. It's a way to help you and your family get the medical care you need, while also making sure you share in the cost

WHAT DOES "MAXIMUM OUT OF POCKET" MEAN?

A maximum out-of-pocket limit is the most amount of money you will have to pay for covered medical expenses in a given year under your health insurance plan. Once you reach that limit, your health insurance company will pay for all covered medical expenses for the rest of the year.For example, let's say your health insurance policy has a maximum out-of-pocket limit of $5,000. If you have a medical expense that costs $10,000, you will pay your deductible and coinsurance up to $5,000, and your health insurance will pay for the remaining $5,000. Once you reach the maximum out-of-pocket limit, your health insurance company will pay for all covered medical expenses for the rest of the year. So, in summary, a maximum out-of-pocket limit is the most you will have to pay for covered medical expenses in a given year under your health insurance plan, after which your health insurance company pays for all covered expenses.

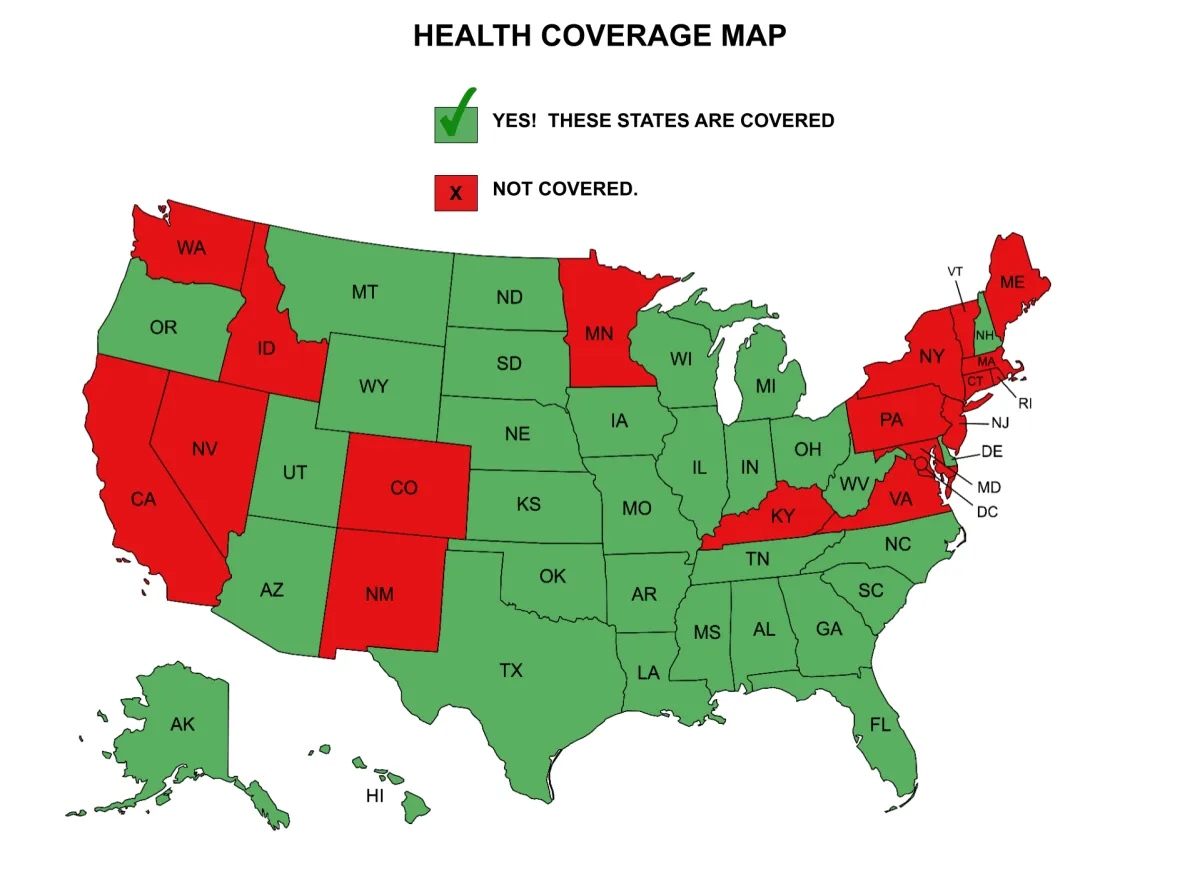

WHAT COMPANIES CAN I GET COVERAGE WITH?

Most of the companies listed here ( Aetna , Ambetter, Bluecross , Molina , CIgna , Oscar, Caresource, United Health). and many more. The options vary from states to state and county to county. Overall most of our clients want the plan with the best coverage for the lowest price. That being said we always make sure that our clients are happy with the coverage they have.

WHAT IS A PREMIUM?

A health insurance premium is the amount of money you pay to your health insurance company for your health insurance coverage. It's usually paid on a monthly basis, and it's a way to maintain your health insurance coverage.Think of it like paying rent for your health insurance policy. You pay a certain amount each month, and in exchange, your health insurance company agrees to pay for certain medical expenses when you need them.The amount of your health insurance premium can vary depending on factors like your age, where you live, and the type of coverage you have. Typically, the more coverage you have, the higher your premium will be.

IS THIS OBAMACARE OR MARKETPLACE HEALTH INSURANCE?

The federal Health Insurance Marketplace, which is also called the "Marketplace" or "Exchange," is the website where individuals can browse various health care plans available under the Affordable Care Act, commonly known as "Obamacare," as well as compare them, and purchase health insurance. So essentially Obamacare and The Marketplace are two sides of the same coin.. The terms are interchangeable.